Key Issue: Cost of Coverage

Spotlight on Affordability

80% of Pennsylvania’s uninsured are concerned about medical debt or financial crisis resulting from illness or injury, and 60% find Pennie’s plans unaffordable.

Pennie provides education on how premium costs affect Pennsylvanians, helping to shape health insurance affordability policies.

Ensuring Access to Affordable, High-quality Coverage

Federal Premium Tax Credits have been an important aspect of affordability for marketplace enrollees since the adoption of the Affordable Care Act. Premium tax credits lower the cost of private health plans available through the marketplace and are based on income and household size.

Since 2021, Enhanced Premium Tax Credits (EPTC) totaling $600 million annually in Pennsylvania alone made coverage more affordable than ever for enrollees. As a result, Pennie saw enrollment increase by 50% from 2021 to 2025. Pennie enrollment reached its highest point at half a million total enrollees in 2025. The enhanced tax credits expired at the end of 2025, and Pennie enrollees saw costs double on average to keep their plan in 2026.

Open enrollment 2026 ended on January 31, 2026, and an unprecedented 85,000 Pennie enrollees made the choice to leave coverage offered through Pennie. Many of these individuals are now uninsured. The terminated population cited the loss of the enhanced tax credits and increased premiums as the primary reason for leaving, and the number leaving continues to grow.

Affordable and accessible health insurance for all eligible Pennsylvanians remains a top priority for Pennie.

2026 Post-OE Data and Impact

-

Since the close of open enrollment on January 31, 2026, Pennie has lost an additional 15,000 consumers.

- In total, including Open Enrollment 2026, Pennie has lost over 104,000 members.

Open Enrollment 2026: Data and Impacts

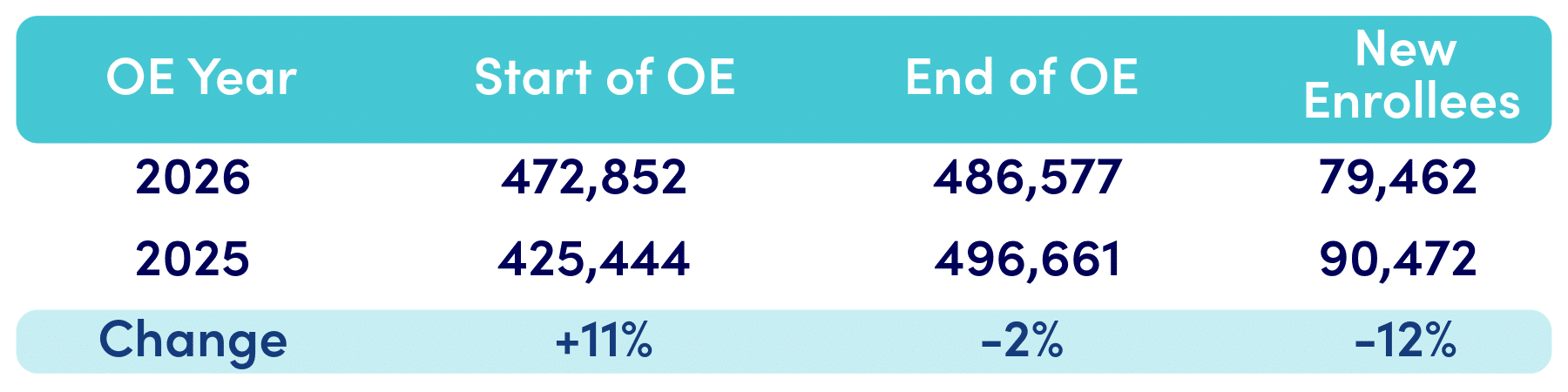

Open Enrollment 2025 v. 2026 Key Takeaways

- During 2026 open enrollment, Pennie saw a 12% decrease in new enrollments compared to 2025.

- Pennie lost a record 85,000 enrollees throughout open enrollment.

- On average, nearly 1,000 Pennsylvanians dropped Pennie coverage each day during open enrollment.

- Compared to 2025, Pennie ended 2026 open enrollment with 2% less enrollees.

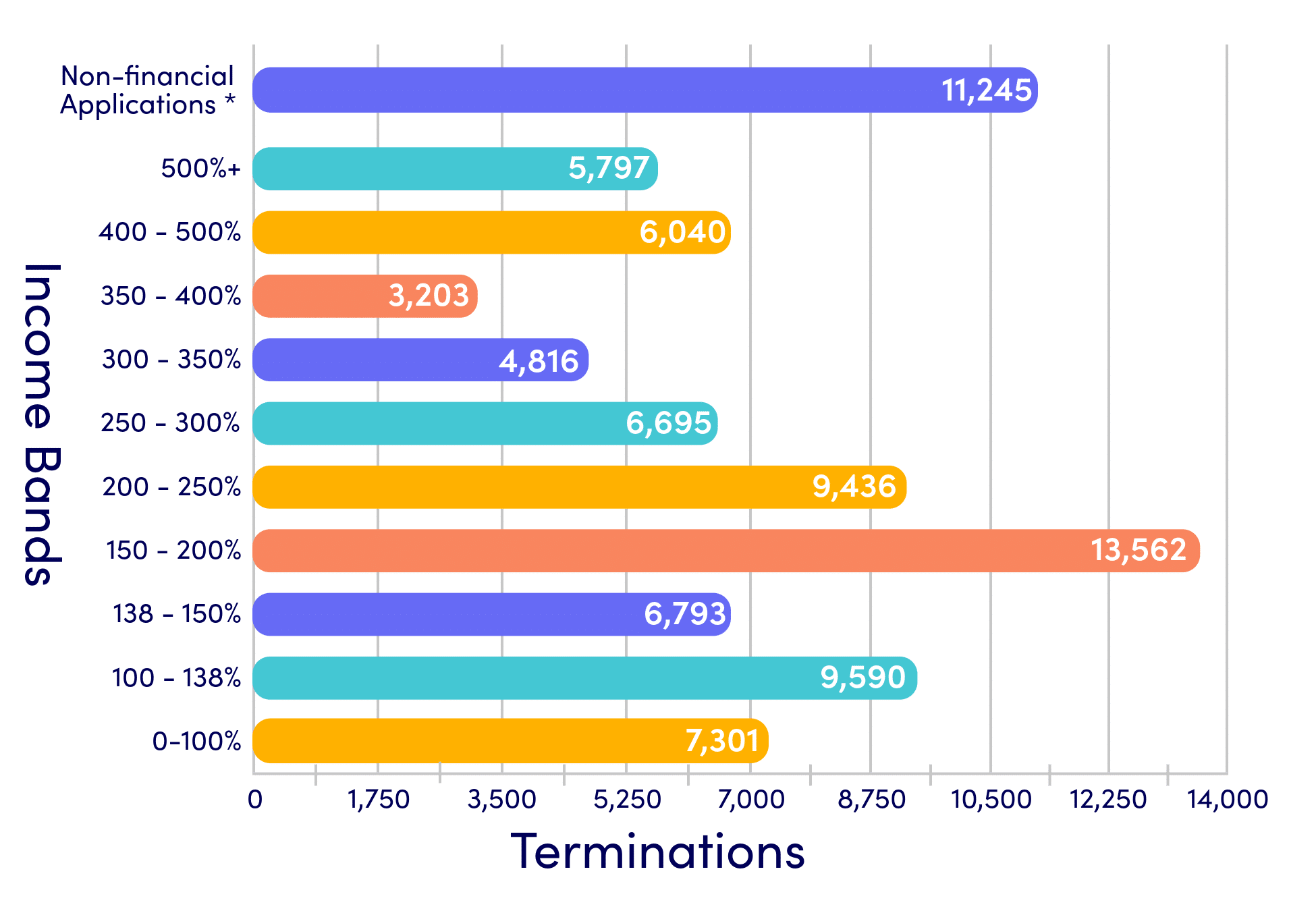

Total Terminations by Income: Through 2/1/2026

*Enrollees either did not apply for premium tax credits, or have lost premium tax credits for administrative reasons and need to update their applications.

- The highest level of terminations by income have been in the 150-200% Federal Poverty Level (FPL) range, $23,475 to $31,300 for a single adult.

- For a family of four, two adults with two children, in the same FPL range, the income would be between $48,225 and $64,300.

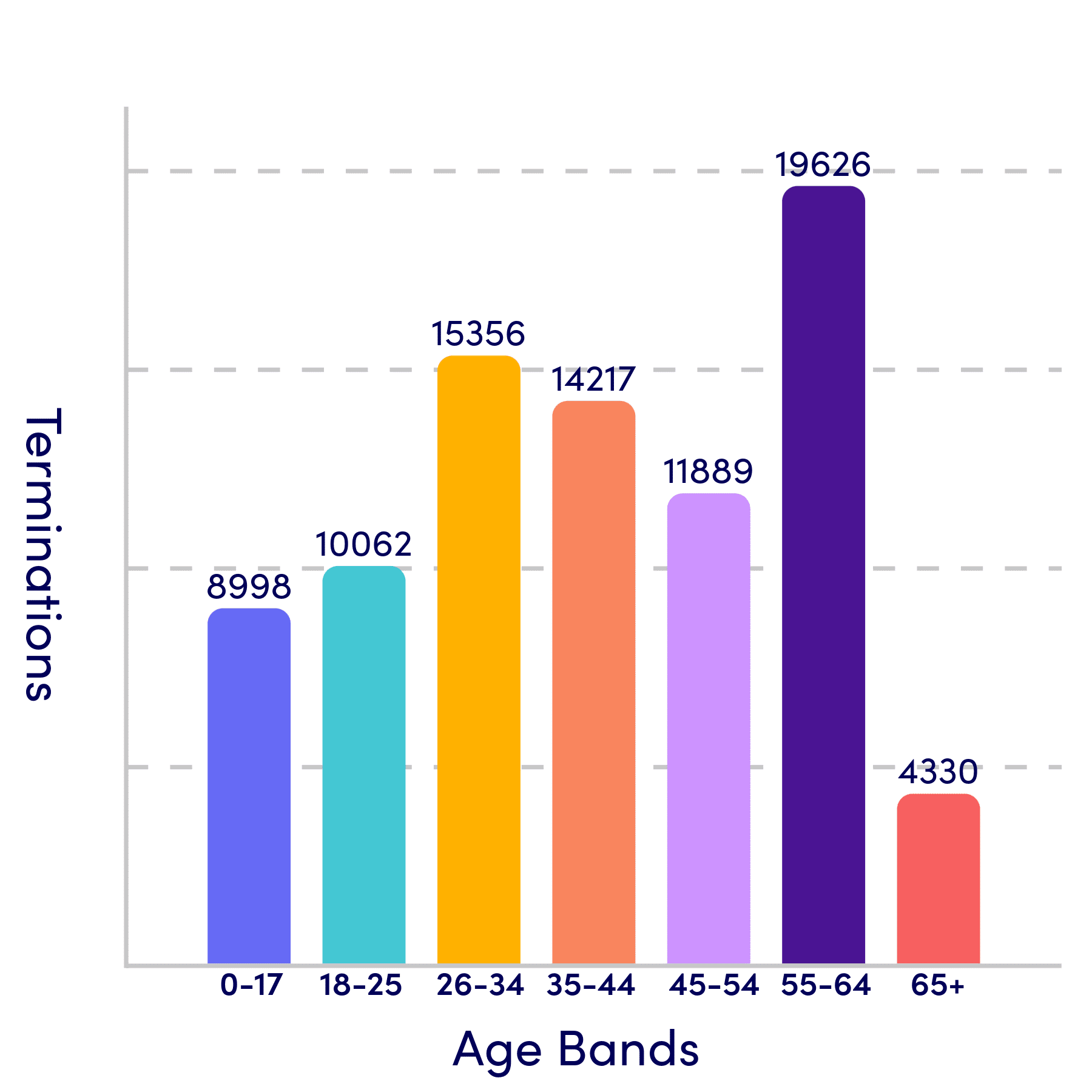

- Individuals and households ages 55-64 are terminating coverage at the highest levels among all age groups.

- Younger, healthier individuals ages 26-34 are terminating coverage at the second highest levels among all age groups, which adversely impacts risk pools and drives premiums higher.

Total Terminations by Age Band: Through 2/1/2026

Terminations by County During Open Enrollment 2026

UPDATED: February 1, 2026

NOTE: Open enrollment closed January 31, 2026.This data reflects point-in-time enrollment information. Check back for future updates.

The Cost of Losing Enhanced Premium Tax Credits for 2026

Impacts of Enhanced Premium Tax Credit Expiration

- The expiration of enhanced premium tax credits drove costs higher leading to 85,000 leaving Pennie coverage.

- On average, premiums increased by 102%.

- See cost increase percentages by county.

- See cost increases by dollar amount by county.

- See cost increases by income.

- See letters to Pennsylvania members of the House and Senate on impacts (June 2025: House and Senate; Sept 2024: House and Senate)

Projected Impacts of EPTC Expiration and Rate Increases by Congressional District – Open Enrollment 2026

NOTE: Click on Congressional District for a worksheet of additional information for this specific region.

COMING SOON: Updated Open Enrollment 2026 Impact data.

Recent News and Statements on Affordability

NOTE: These are external links. By clicking on them you will be leaving Pennie’s website. Links to other websites are provided solely for the convenience of the user and do not constitute an endorsement or recommendation of those websites.

Establishing a State Health Insurance Affordability Program

Since opening our doors in 2021 (PDF), Pennie has consistently heard that cost is a primary barrier to coverage for many uninsured Pennsylvanians. Pennie’s research shows that many uninsured individuals find health coverage to be unaffordable, despite the availability of federal tax credits. (Learn more: Pennie Uninsured Survey (PDF)) These insights highlight the critical need for the Commonwealth to explore additional cost-assistance measures.

Pennie has partnered with state lawmakers to explore ways to reduce the cost of health coverage. As part of the 2024-2025 Pennsylvania State Budget, Pennie gained the authority to establish the State Health Insurance Exchange Affordability Program. Once funded, this program will provide premium assistance to eligible Pennsylvanians, making coverage more affordable. Pennie continues to engage with lawmakers and stakeholders, highlighting the importance of funding this program and the significant benefits it will deliver to Pennsylvanians.

How The State Affordability Program Helps:

-

-

- Increases economic and financial security for individuals across Pennsylvania.

-

- Improves health outcomes for enrollees with better and more consistent access to medical care.

-

- Strengthens the individual health insurance market by improving the risk pool.

-

Learn more about what our partners are saying about the need for a state subsidy program:

https://pahealthaccess.org/pa-organizations-release-letter-in-support-of-pennie-subsidies/