Key Issue: Cost of Coverage

Spotlight on Affordability

80% of Pennsylvania’s uninsured are concerned about medical debt or financial crisis resulting from illness or injury, and 60% find Pennie’s plans unaffordable.

Pennie provides education on how premium costs affect Pennsylvanians, helping to shape health insurance affordability policies.

Maintaining Federal Premium Tax Credits

- Affordable and accessible health insurance for all eligible Pennsylvanians is a top priority for Pennie.

- As a result of federal policies to address affordability, Pennie has experienced an enrollment increase of 50% since 2021. Pennie enrollment reached its highest point at over half a million total enrollees in 2025.

- Open Enrollment 2026 is under way and Congress has not extended the Enhanced Premium Tax Credits (EPTC), which are set to expire December 31, 2025.

- Federal Premium Tax Credits have been an important aspect of affordability for marketplace enrollees since the adoption of the Affordable Care Act.

- Since 2021, Enhanced Premium Tax Credits (EPTC) totaling $600 million annually were made available to make coverage more affordable for enrollees. Because they may no longer be available, Pennie enrollees are expected to see, on average, a 102% increase in premiums.

Enhanced premium tax credits have made affordable health coverage a reality for many Pennsylvanians for the first time. Without them, costs will rise sharply, forcing nearly half a million people to choose between their health and their financial security. Keeping these tax credits in place means Pennsylvanians can continue to access essential care and protect themselves from medical debt—benefits that ripple through our families, communities, and the entire healthcare system.

The Cost of Losing Enhanced Premium Tax Credits for 2026

Impacts to Entire Commonwealth

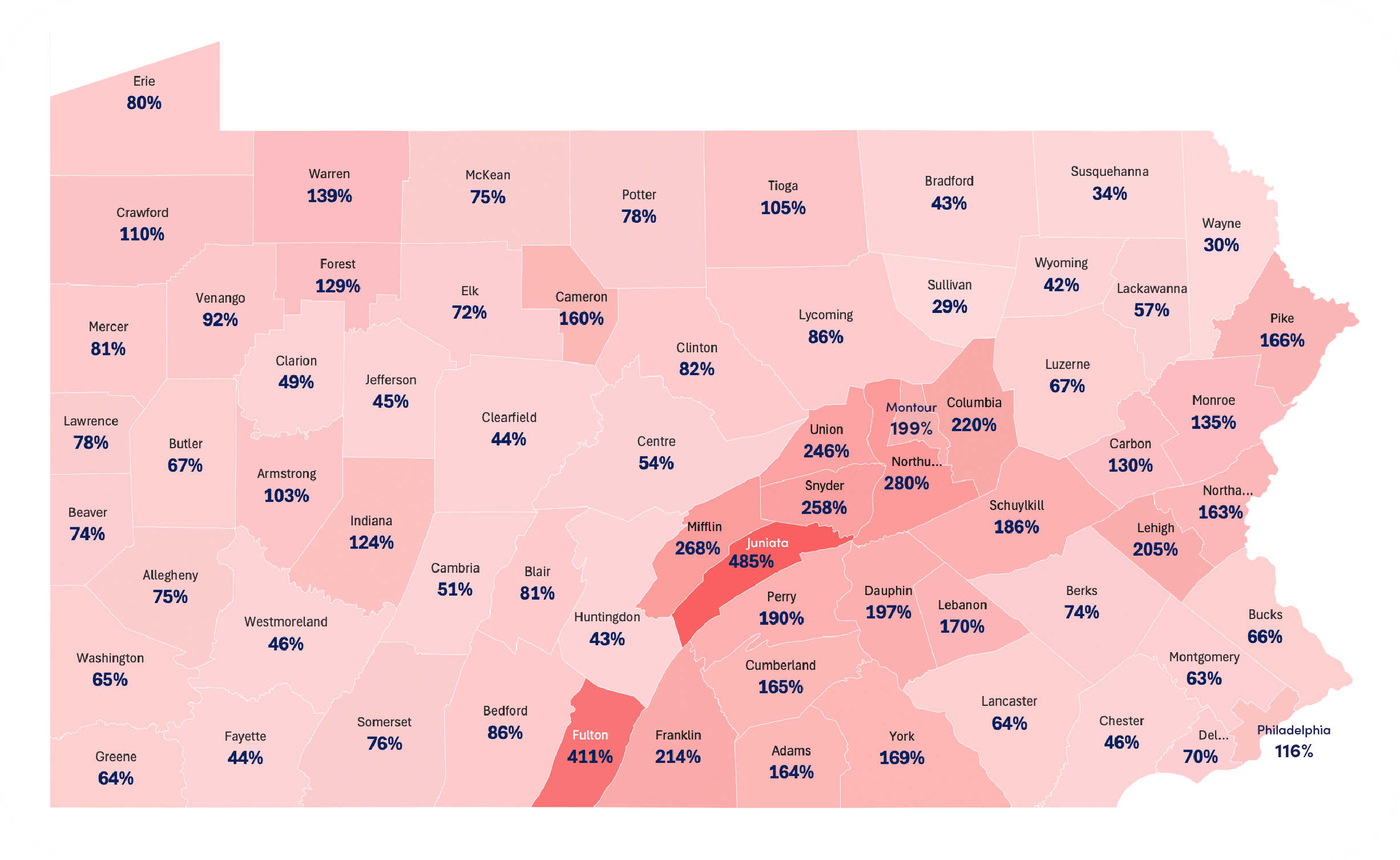

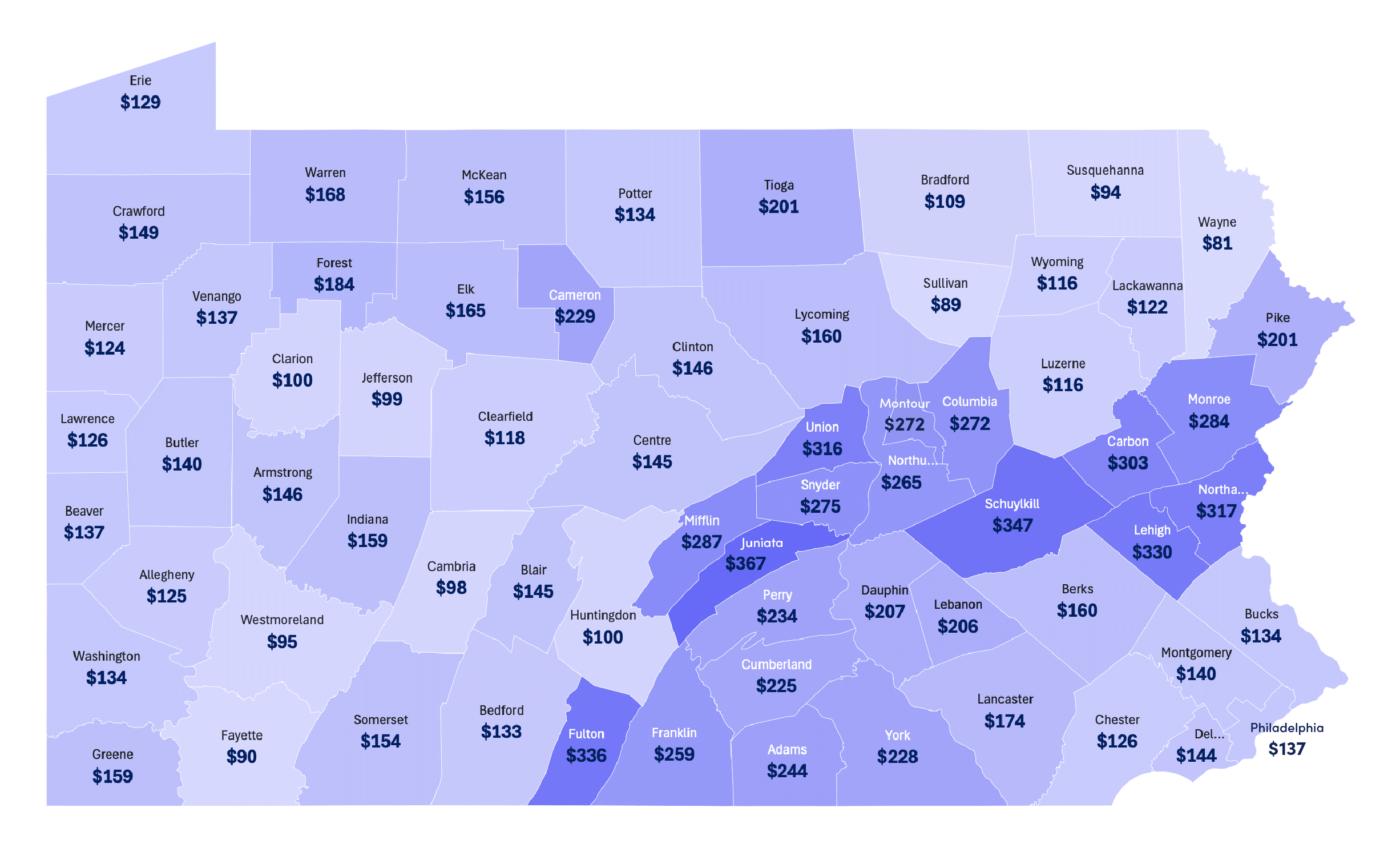

- Rural counties are experiencing a disproportionately high financial impact, as rural residents will lose more premium tax credit dollars than those in urban counties.

- Urban counties have more enrollees and are expected to have higher levels of disenrollment due to the expiration of the enhanced premium tax credits.

Average monthly percentage increase per policy.

Average 2026 cost increase per member per month.

Open Enrollment 2026: Data and Impacts

- Since the start of open enrollment, Pennie has seen a 25% decrease in new enrollees from OE 2025 to OE 2026.

- On average, 1,000 Pennsylvanians have been dropping coverage each day during open enrollment.

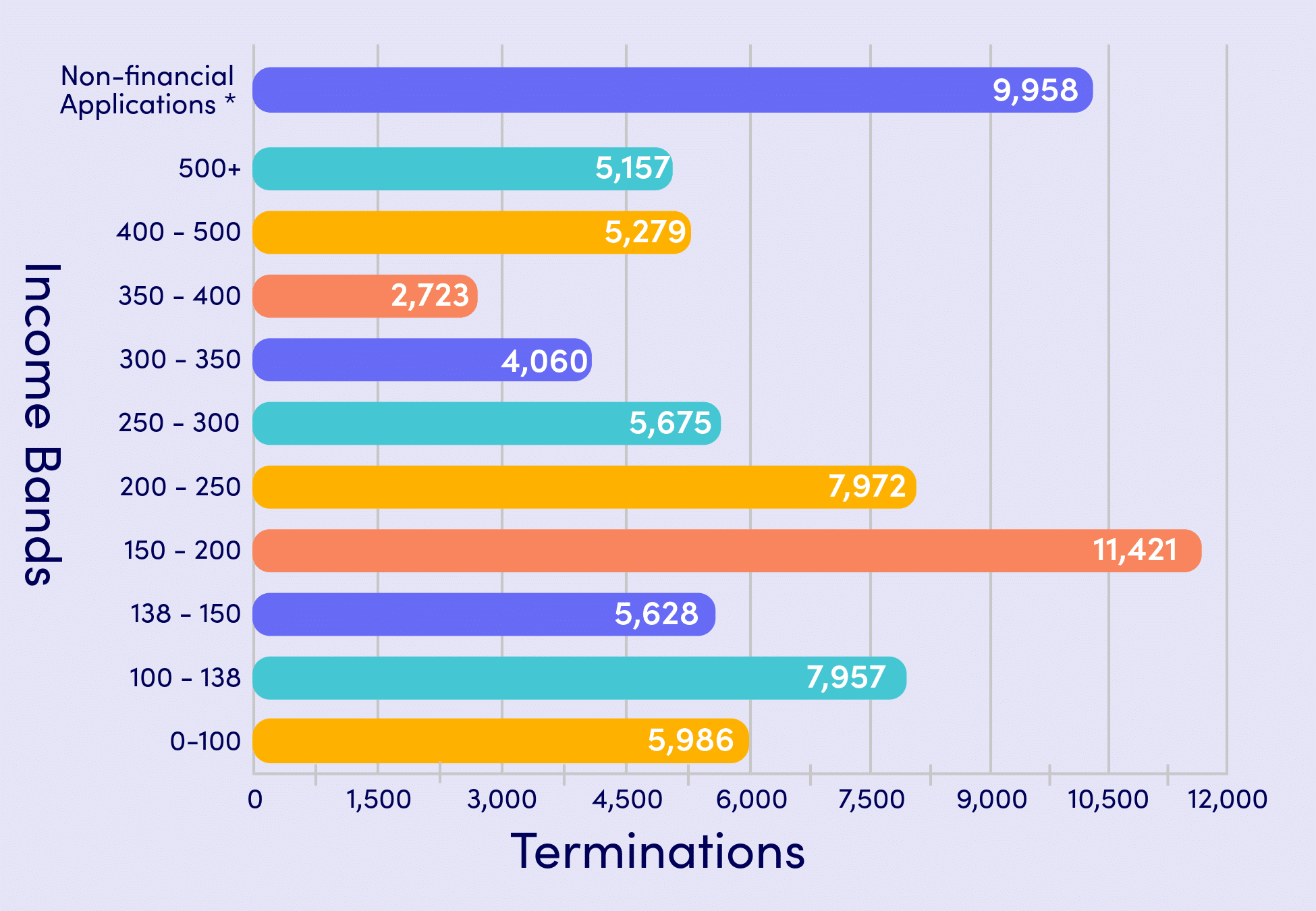

Total Terminations by Income: Through 1/20/2026

*Enrollees either did not apply for premium tax credits, or have lost premium tax credits for administrative reasons and need to update their applications.

- The highest level of terminations by income have been in the 150-200% Federal Poverty Level (FPL) range, $23,475 to $31,300 for a single adult.

- For a family of four, two adults with two children, in the same FPL range, the income would be between $48,225 and $64,300.

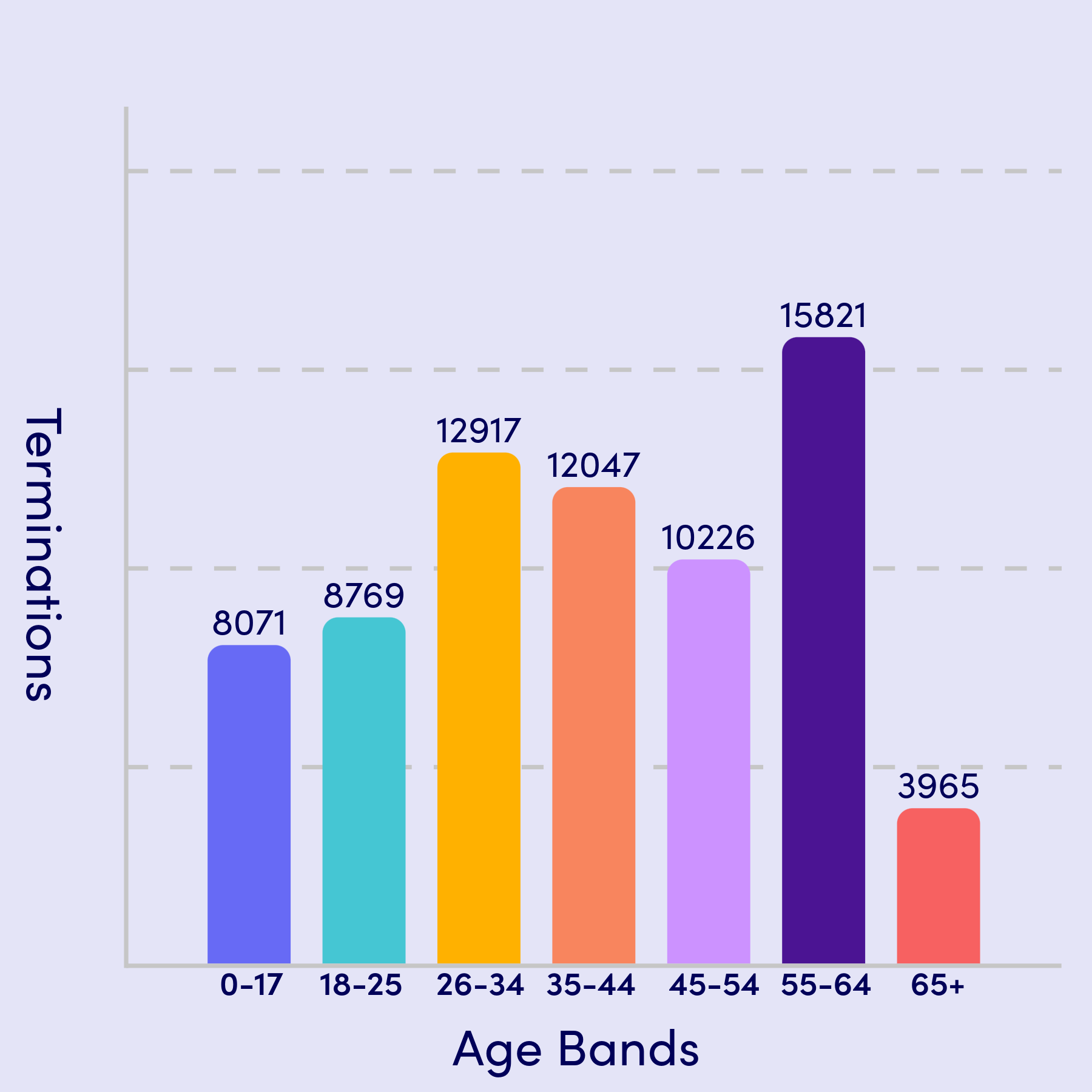

- Individuals and households ages 55-64 are also terminating coverage at the highest levels among all age groups.

- Younger, healthier individuals ages 26-34 are terminating coverage at the second highest levels among all age groups, which adversely impacts risk pools and drives premiums higher.

Total Terminations by Age Band: Through 1/20/2026

NEW: Terminations by County During Open Enrollment 2026

UPDATED: January 20, 2026

NOTE: This data reflects point-in-time enrollment information. These trends and figures are subject to change throughout Open Enrollment. Please check back for updates.

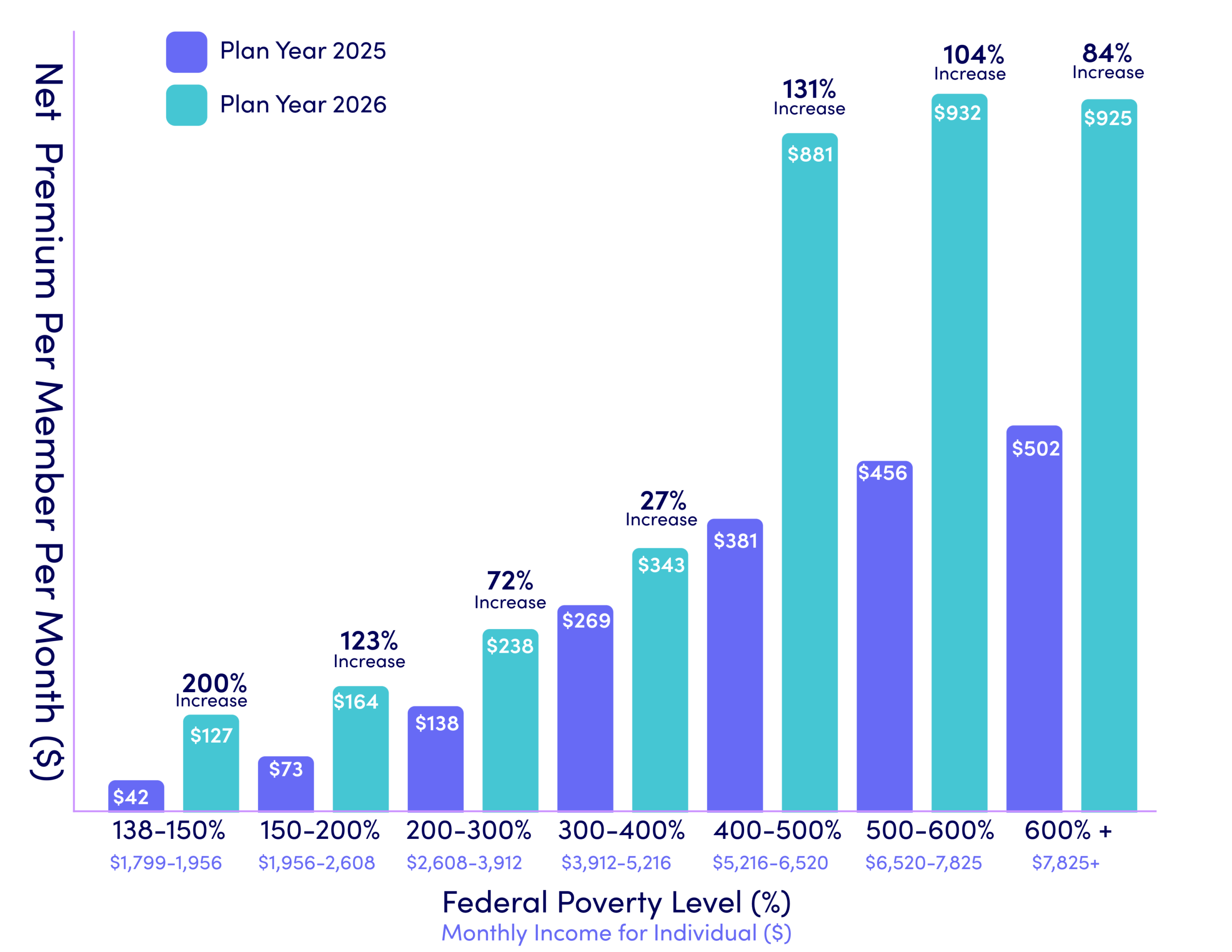

2026 Average Premium Increase by Income Level

The premium increases in the chart are reflective of the impact of the expiration of Enhanced Premium Tax Credits (EPTC) and approved health insurance rates by the PA Insurance Department.

- Monthly costs for Pennie enrollees will increase by 102% on average.

- While higher income earners will experience steeper cost increases, lower income earners will experience larger increases proportional to what they have been paying.

Impacts of EPTC Expiration and Rate Increases by Congressional District – Open Enrollment 2026

NOTE: Click on Congressional District for a worksheet of additional information for this specific region.

Letters from Pennie to Federal Lawmakers

Pennie is educating Pennsylvania policymakers and stakeholders on the expected impacts of losing the enhanced premium tax credits. Preserving them is essential to safeguarding the health and financial well-being of Pennsylvanians across the Commonwealth. More details and supporting data can be found in the documents below.

June, 2025

Pennie & PA Insurance Dept. Letter to House Delegation on Reconciliation Bill (PDF)

Pennie & PA Insurance Dept. Letter to Senate Delegation on Reconciliation Bill (PDF)

September, 2024

Recent News and Statements on Affordability

NOTE: These are external links. By clicking on them you will be leaving Pennie’s website. Links to other websites are provided solely for the convenience of the user and do not constitute an endorsement or recommendation of those websites.

Establishing a State Health Insurance Affordability Program

Since opening our doors in 2021 (PDF), Pennie has consistently heard that cost is a primary barrier to coverage for many uninsured Pennsylvanians. Pennie’s research shows that many uninsured individuals find health coverage to be unaffordable, despite the availability of federal tax credits. (Learn more: Pennie Uninsured Survey (PDF)) These insights highlight the critical need for the Commonwealth to explore additional cost-assistance measures.

Pennie has partnered with state lawmakers to explore ways to reduce the cost of health coverage. As part of the 2024-2025 Pennsylvania State Budget, Pennie gained the authority to establish the State Health Insurance Exchange Affordability Program. Once funded, this program will provide premium assistance to eligible Pennsylvanians, making coverage more affordable. Pennie continues to engage with lawmakers and stakeholders, highlighting the importance of funding this program and the significant benefits it will deliver to Pennsylvanians.

How The State Affordability Program Helps:

-

-

- Increases economic and financial security for individuals across Pennsylvania.

-

- Improves health outcomes for enrollees with better and more consistent access to medical care.

-

- Strengthens the individual health insurance market by improving the risk pool.

-

Learn more about what our partners are saying about the need for a state subsidy program:

https://pahealthaccess.org/pa-organizations-release-letter-in-support-of-pennie-subsidies/