Changes For 2026

What’s New – Changes for Pennie Enrollees

Due to federal law, there are some changes coming to Pennie. These changes impact the cost of health coverage as well as other enrollment requirements.

What’s happening with the cost of Health Coverage?

New to 2026:

-

Starting in 2026, monthly payments have increased.

-

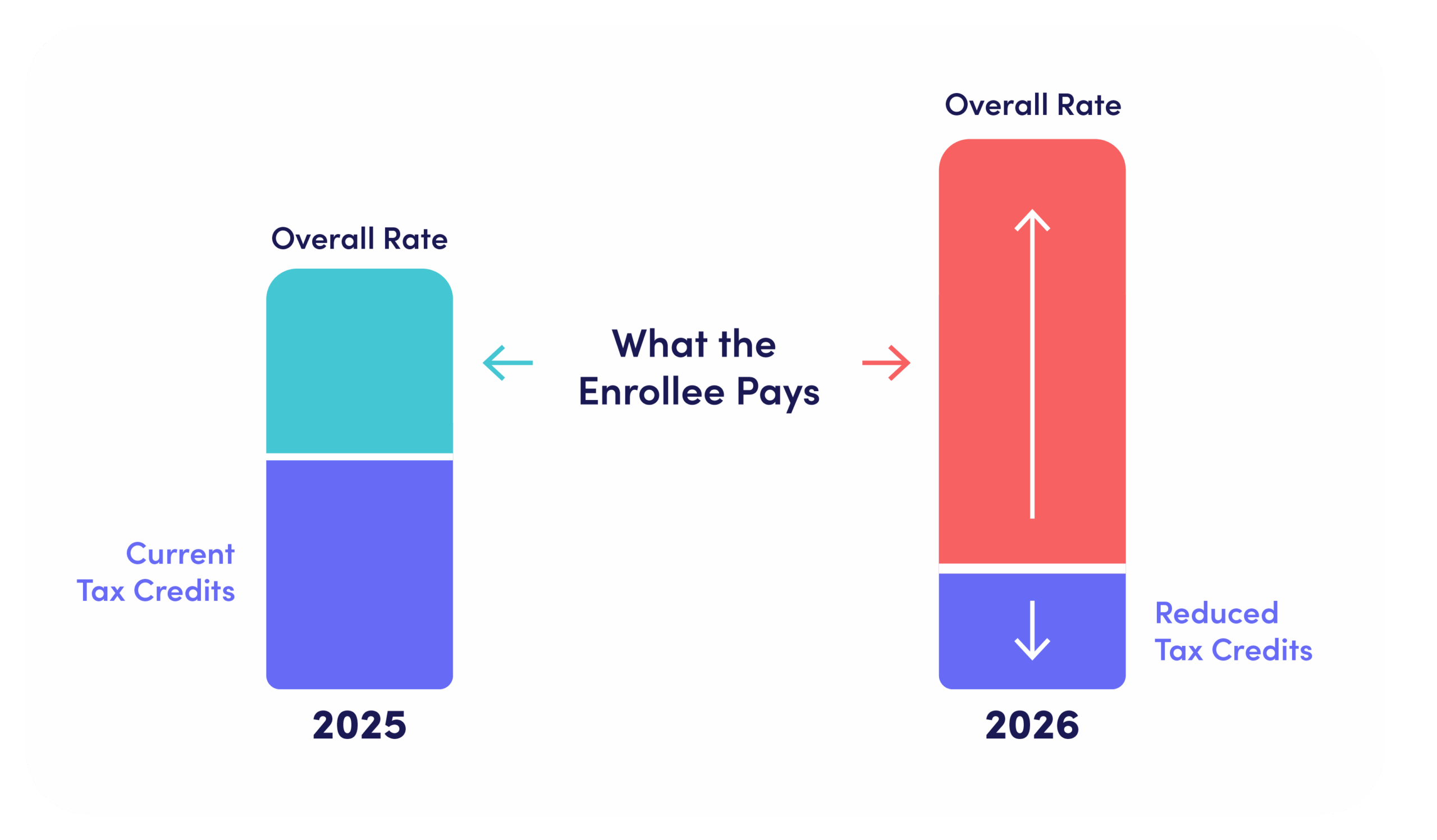

Since 2021, the federal government has offered enhanced tax credits to make health insurance cheaper for Pennie enrollees. These enhanced tax credits expired December 31, 2025 due to Congress not extending the enhanced tax credits for 2026.

-

There are still some tax credits for people who qualify, but the amount will be smaller. People who make around $62,600 a year or more (around $84,600 for a couple) won’t qualify for any tax credits.

Other Reasons Your Monthly Payments May Increase

-

-

- Changes in your household income, family size, or tax filing status.

- Failure to submit verification documentation, click here to learn more.

- Failure to report Advanced Premium Tax Credits in past years on your federal tax return, click here to learn more.

- A new insurance company started selling plans in your area and it has impacted your tax credits and premiums.

- Due to a new federal law, you may no longer be eligible for financial savings if you are an individual under the 5-year bar and earning under $15,650/yr, click here to learn more.

- If you have any questions, please call Pennie Customer Service at 844-844-8040.

-

What Can I Do?

- READ EVERYTHING Pennie or your insurance company sends you.

- While Open Enrollment has now ended, you still have a chance to enroll in a new plan that best fits your budget through a Special Enrollment Period if you have a Qualifying Life Event.

- Pennie is here to help. Check out pennie.com/connect for free assistance when exploring your plan options.

- Want to do a deeper dive? Visit Pennie’s Affordability webpage. There you can find data, customer stories, news articles and more.

Other Federal Changes

1. What other changes are happening at Pennie due to federal law?

-

- There are several important changes that are coming to Pennie due to new federal regulations and H.R. 1 of 2025 (also known as the One Big Beautiful Bill) that was signed into law.

- The new laws are changing who qualifies for financial savings to help pay for health coverage through Pennie. Those with lawfully present immigration statuses may no longer qualify for financial savings. Click here to learn more.

- New policies also increase the steps to verify information and sign up for coverage. Some enrollees may need to submit more documents to get coverage. We will contact you if we need more documentation. Documents need to be submitted quickly so you don’t lose your financial savings or your health coverage.

- Higher penalties were added if your income changes during the year and you don’t update your account info. Current enrollees must update their income for 2026. All enrollees must update income throughout the year if it changes.

2. What can I do about these changes?

-

- Pennie will be in constant communication with any impacted enrollees on any enrollment changes. You should read all communications from Pennie and your insurance company.

- The best thing for you to do is to make sure your information is updated with any changes throughout the year in your Pennie account if you have already enrolled in 2026 coverage.

- Plans and prices change every year, especially this year. Due to these federal changes, there are increased penalties if your income information is not up to date.

3. What do Pennie plans provide compared to other plans outside of Pennie?

- Pennie is still the only place where you can receive financial savings. These savings are in the form of a federal premium tax credit. Pennie is the only way to receive these tax credits to lower the cost of health coverage.

- Plans through Pennie cover a full range of medical care. This includes coverage for pre-existing conditions and free preventive services. Pennie also guarantees important protection from low-quality health plans and scams.

- All health plans through Pennie must help pay for 10 essential health benefits, including:

- • Doctor Visits & Checkups

- • Emergency Care

- • Hospital Stays & Surgeries

- • Pregnancy & Newborn Care

- • Mental Health & Substance Use Treatment

- • Prescription Drugs

- • Rehabilitation & Therapy Services

- • Lab Tests

- • Preventative Care & Wellness

- • Pediatric Care, including dental and vision care

4. Considering your health plan options outside of Pennie?

Know before you go: click here for a cheat sheet with the questions to ask before you enroll in health coverage elsewhere.

Tell us what having Pennie coverage means for your health and family.

"*" indicates required fields